The Asian Banker Technology Implementation Awards 2009

The following are the winners of The Asian Banker IT Implementation Awards. This award aims at recognising the best practices in the Asia-Pacific banks that emerge from the use of technology and make significant difference to the bank’s functional ability. The winners are banks that had successfully implemented or made fully functional their IT projects by the year 2008. The winning entries will also be developed into case studies and promoted as best practices in the region.

Awards presented by

Philip Strause, international resource director, The Asian Banker and Alex Escucha, chairman, IT Implementation Awards panel of judges, and first vice president, China Banking Corp., Philippines

Panel of Judges

Alex Escucha, chairman, IT Implementation Awards panel of judges, and first vice president, China Banking Corp., Philippines

Nick Dean, business technology partner, regional & country operations, ANZ Asia Pacific

Voranuch Dejakaisaya, chief information officer, GE Money Thailand

Neil Katkov, senior vice president, Asia Research, Celent

Axel Winter, director, financial services, Deloitte

Mac Kaylan, managing partner, Black Ice Partners

Steven Miller, dean, School of Information Systems, Singapore Management University

Award: Best ATM Installation and Management Project in Asia Pacific

Winning bank - Chinatrust Commercial Bank

Winning vendor - Mercuries Data Systems |

|

From left to right: Philip Strause, international resource director, The Asian Banker, Bell Chong, chief representative, Chinatrust Commercial Bank, and Alex Escucha, chairman, IT Implementation Awards panel of judges, and first vice president, China Banking Corp., Philippines

|

Chinatrust Commercial Bank and technology partner won this award for successfully implementing a new self-service strategy in the Taiwanese banking sector. The bank became the first lender in the country to deploy cash recycling ATMs on a large scale basis in off premise locations. The new system includes a monitoring and management function and allows information exchange and maintenance coordination without sending any staff down to the machines.

The project implementation allows Chinatrust to deliver value-added services to customers from multiple ATM capabilities with higher transaction volume capacity. It has also resulted in lower operational costs from reduction in manpower management, and in a decrease in operation loading and cash inventory turnover. |

Best Call Centre Project Award 2009

Winning bank – Taishin International Bank

Winning vendor – Octon, Intumit |

|

From left to right: Philip Strause, international resource director, The Asian Banker, Kevin Ren, director, business development division, Intumit, Josephine Yang, SVP, head of IT services division, Taishin International Bank, Joy Pan, product director, Octon, and Alex Escucha, chairman, IT Implementation Awards panel of judges, and first vice president, China Banking Corp., Philippines

|

Taishin Bank and technology partners Octon and Intumit won this award for the innovative upgrade of the Taiwan bank’s computer telephony integrated (CTI) system in 2008. The project was initiated as the prior CTI system was incapable of sufficiently handling the increasing demands associated with dynamic market changes.

Aside from the performance improvement and enhanced security of the CTI system, the project also enabled several service upgrades to create a customer service knowledge management system. The other upgrades include a new voice mail and call back system, wherein clients can leave a message for agents when the lines are busy. The new system also permits the integration of creative marketing efforts onto the platform, for example, the provision of automatic credit card installment payments from the interactive voice response (IVR) system, hence speeding up up the card application process. |

Best Core Banking Project/Honorable special mention for most innovative entry

Winning bank – Jibun Bank Corporations

Winning vendor –Oracle Financial Services |

|

From left to right: Philip Strause, international resource director, The Asian Banker, Takeo Tohara, president, Jibun Bank Corporations, Yutaka Kawajiri, sales director, Oracle Financial Services, and Alex Escucha, chairman, IT Implementation Awards panel of judges, and first vice president, China Banking Corp., Philippines.

|

Japan’s Jibun Bank and technology partner Oracle Financial Services Software have been awarded for implementing the best core banking project in Asia Pacific in 2008. The bank and the vendor also received an Honourable Special Mention for “Most Innovative Entry”.

Jibun Bank is a joint venture between Japanese telecommunication company KDDI and Bank of Tokyo-Mitsubishi UFJ. The core banking project was initiated to realise the vision of turning the lender into a virtual bank with the mobile phone as the primary channel. Given the unique business model of the Japanese institution, the implementation team had to innovate, re-engineer and custom build core application processes to suit operations to the mobile phone while keeping ease of transaction and robust security as key priorities. With the implementation of this technology, Jibun Bank managed to acquire 500,000 accounts in just eight months. |

Best CRM/Applications Project Award 2009

Winning bank – Kotak Mahindra

Winning vendor – Oracle |

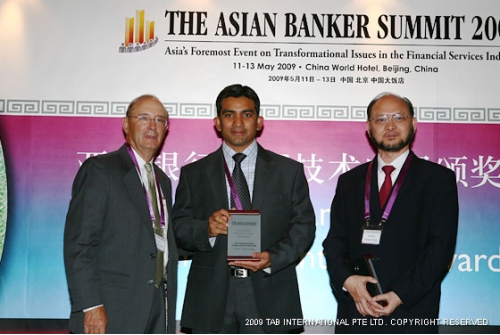

|

From left to right: Philip Strause, international resource director, The Asian Banker, Patrick Ng, director, Financial Services Industry business unit, Asia Pacific, Oracle Financial Services, and Alex Escucha, chairman, IT Implementation Awards panel of judges, and first vice president, China Banking Corp., Philippines

|

Kotak Mahindra Bank and technology partner Oracle Financial Services Software won this award for developing a group-wide CRM application that tracks all customer interactions. The new system integrates data across all segments of the group in a single instance. Internal unique identifiers were drawn up in order to minimise duplication and organise the data effectively.

With the new system, the bank has been able to reduce its service and support costs, and improve customer service from lower call drop rates and better call centre quality and response times. Specialised marketing campaigns conducted in 2008 were successful, with one third of the customer base reached by the campaigns. The system also boosted the cross selling ratio by leveraging synergies across various customer segments. |

Best Data and Analytics Project Award 2009

Winning bank – Alliance Bank

Winning vendor –SAS Institute |

|

From left to right: Philip Strause, international resource director, The Asian Banker, Jimmy Cheah, managing director, SAS, Bridget Lai, group CEO, Alliance Bank Malaysia, and Alex Escucha, chairman, IT Implementation Awards panel of judges, and first vice president, China Banking Corp., Philippines

|

Alliance Bank Malaysia and technology partner SAS Institute won this award for developing a comprehensive data warehousing and analysis solution for application across the whole financial institution. The new system provides a single view of the customer and allows the bank to enhance customer segmentation to enables targeted marketing and improved risk management.

The new system is easily scalable for bigger volumes and has the ability to include more solution components to create additional subject-oriented data marts for specific projects. Despite a difficult year for the financial services industry, the bank showed double digit growth of assets under management in 2008. Also, more customers were holding more products of the bank, due to an outstanding improvement in the cross-selling abilities. |

Best E- Banking Project Implementation Award 2009

Winning bank – ICICI Bank

Winning vendor – Infosys Technologies |

|

From left to right: Philip Strause, international resource director, The Asian Banker, Anand Arkalgud, head of sales, Greater China region, Infosys Technologies, and Alex Escucha, chairman, IT Implementation Awards panel of judges, and first vice president, China Banking Corp., Philippines

|

ICICI Bank and technology partner Infosys Technologies won this award for the establishment of an innovative and customer-friendly direct banking platform. Customers can do banking—from opening an account to transferring funds—online and can have a complete view of all accounts on a single dashboard. The new system operates smoothly with the bank’s existing ATM, mobile and call centre systems.

From the soft launch of the direct banking service, ICICI received 50-70 applications for account opening every day. The average bank balance of deposits opened was 25% higher than the average bank balance of the conventional bank customer, and uptime availability was maintained at 99.5%. |

Best Enterprise Transformation Project Award 2009

Winning bank – Alliance Bank Malaysia

Winning vendor – IBM |

|

From left to right: Philip Strause, international resource director, The Asian Banker, Millie Yong, business manager, Financial Services Sector, Bridget Lai, group CEO, Alliance Bank Malaysia, and Alex Escucha, chairman, IT Implementation Awards panel of judges, and first vice president, China Banking Corp., Philippines

|

Malaysia’s Alliance Bank and technology partner IBM won this specially created for effective enterprise banking transformation. The bank has upgraded capacity dramatically. For the past three years, IT transformation allowed the number of branches, privilege banking centres, and electronic lobby capabilities to increase substantially. In terms of efficiency, the branch resource and processes have been optimised by shortening customers’ queue time and increasing over-the-counter transactions without increasing head count in branches. Standards for application integration have also been introduced to reduce the cycle of deployment for future interfaces. With the implementation of technology, Alliance’s profit before tax improved by $246.98 million from March 2006 to March 2008.

In a short span of 2.5 years, Alliance Bank also introduced a host of new Alliance Online services. Implementations allowed the bank to upgrade the loyalty system, enable customers to make purchases through merchants' websites, provide more bill payments service and launch the Premium Debit MasterCard. |

Best Retail Payment Project Award 2009

Winning bank – Citibank (China)

Winning bank – China UnionPay Data Services |

|

From left to right: Philip Strause, international resource director, The Asian Banker, Zhong Qi, vice manager, China UnionPay Data Services, Steven Tan, vice president, Country Technology and Re-engineering head, and Alex Escucha, chairman, IT Implementation Awards panel of judges, and first vice president, China Banking Corp., Philippines

|

Citi China and technology partner China UnionPay Data Services (CUP Data) won this award for outstanding system integration of the bank’s debit card technology infrastructure with that of the solutions provider. This partnership was created from the strategic plan to set up debit card processing and customer information systems within China. The collaboration results in the development of an online interface for exchange of real-time account information and transaction settlement processes.

The application provides a powerful channel for customers to access the Citibank retail payment services. The collaborative approach allows Citi China to enhance banking experience and convenience by providing customers with access to ATM and POS facilities as well as mobile payment capabilities. Through this implementation, Citi China was able to deliver the debit card to its customers and introduce mobile payment services, which was the first for a foreign bank in China, besides increasing customer satisfaction, loyalty and cross-selling prospects for the bank.

|

Best Risk Management Implementation Award 2009

Winning bank – Bank of Communications

Winning vendor – FICO |

|

From left to right: Philip Strause, international resource director, The Asian Banker, John Chen, vice president, FICO, Lynn Ye, senior manager, Risk Management & Control, and Alex Escucha, chairman, IT Implementation Awards panel of judges, and first vice president, China Banking Corp., Philippines

|

Bank of Communications and technology partner FICO won this award for the development of the first enterprise decision management project in China that involves a holistic integration of the entire credit card lifecycle. It comprises three applications covering different lifecycle stages: Capstone Decision Accelerator (CDA) deals with origination, TRIAD for account management and Model Builder for model and strategy development.

The CDA provides risk management department with a real-time, automated credit card origination function by deploying credit scoring, policies and rules, while TRIAD enables the bank to develop and implement the entire strategic management actions for the multiple decision areas of credit card operations in great speed and accuracy. Advanced set of modeling technologies also allows the lender to predict profit-related factors including risk and customer profitability. The system brought increased revenue, higher efficiency and effectiveness in account origination and management, improvement in overall customer relationship managements, reduction in non-performing loan and collection costs. |

Best Trade Finance Project Award 2009

Winning bank – Kasikornbank

Winning vendor – Progress Software |

|

From left to right: Philip Strause, international resource director, The Asian Banker, Songpol Chevapanyaroj, first SVP, Corporate Business division, Kasikornbank, and Alex Escucha, chairman, IT Implementation Awards panel of judges, and first vice president, China Banking Corp., Philippines

|

Kasikornbank (KBank) and technology partner Progress Software were given this award for building a centralised processing centre for the bank’s international trade business, replacing the former disparate system. The new system provided the Thai with a competitive edge in trade finance by establishing a Spoke (previously called International Trade center) in a particular customer's office to provide full trade finance services, pre-checking export documents, and document preparation services.

At present, KBank is the only bank in Asia with its system directly integrated with DHL's. In terms of capacity upgrade, the bank currently has the highest numbers of fully International Trade service centres covering every 20 km in Bangkok and Metropolitans. With the new system, KBank is able to continuously increase productivity and financial result without recruiting more staff, and it also became the first bank in Thailand to set service level agreement. This project has also been used as a model by the Thai government for the national IT transformation implementation. |

Best Trading Back Office Project Award 2009

Winning bank – Royal Bank of Scotland (Singapore & UK)

Winning vendor – SmartStream Technologies |

|

From left to right: Philip Strause, international resource director, The Asian Banker, Anthony Campbell-Brown, sales director, Asia Pacific, SmartStream, Peh Bee Leng, head of Treasury Operations & Investigations, Asia Pac, RBS, Peter Akwaboah, head of Treasury Operations, RBS, and Alex Escucha, chairman, IT Implementation Awards panel of judges, and first vice president, China Banking Corp., Philippines

|

The Royal Bank of Scotland (RBS) and technology partner SmartStream Technologies won this award for implementing a smart and robust integrated confirmation platform. The real time integrated platform within the system communicates to all the required reconciliation and electronic platforms on real time basis. The system proactively highlights discrepancies to ease investigation for pre-emptive solutions.

The project implementation helped RBS to improve its match rates and reduce the number of errors (exceptions). The enterprise control mechanism allows the bank to manage its growing transaction volumes. In addition, the platform also displays statistical KPI and Key Risk Indicators related to the transaction processes. The integrated capability means that the system can support RBS’s Global Banking & Markets Global FX Business with multiple offices across five continents. |

Honorable special mention for the most innovative entry

Winning bank – Jibun Bank Corporations

Winning vendor – Oracle Financial Services |

|

From left to right: Philip Strause, international resource director, The Asian Banker, Takeo Tohara, president, Jibun Bank Corporations, Yutaka Kawajiri, sales director, Oracle Financial Services, and Alex Escucha, chairman, IT Implementation Awards panel of judges, and first vice president, China Banking Corp., Philippines

|

| Group photo of the winners of The Asian Banker IT Implementation Awards 2009 |

|

|