Evaluation Scorecard Transaction for Transaction Banking, Frictionless and Bankers’ Choice Awards

Every year, TAB Global recognises achievements in the key business and operational areas of the financial services industry. The purpose of these awards is to recognise annual achievements and winners in the competition for market share, product and operational excellence.

Institutions will be evaluated across dimensions such as financial performance, customer experience, products and services, digital and other tangible achievements. Please note the changes in our scorecard and associated elements which have been modified to capture quantitative achievements for us to benchmark your institution more efficiently.

We assess transaction finance players based on their ability to help clients take advantage of the supply and value chain dynamics by using their credit, liquidity, technology and financial standing as a competitive advantage.

| Dimension Code | Dimension | Transaction and Cash Management Indicator | Trade Finance Indicator | Payments/FX Indicator |

Sustainability Indicator

BM comprises 20% for this category

PS comprises 20% for this category

TI comprises 5% for this category

|

|---|---|---|---|---|---|

| CX |

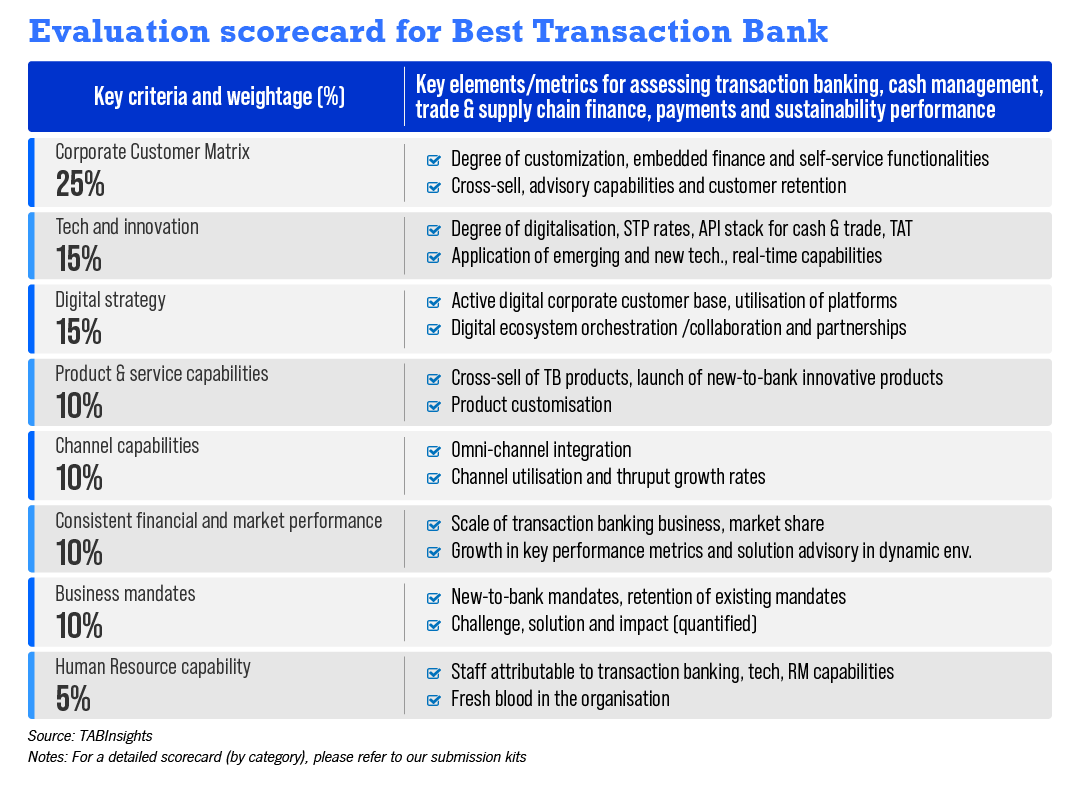

Corporate customer matrix (25%)

We want gauge the relationship with your corporate clients through their experiences of key services and your own business structure |

|

|

|

|

| TI |

Technology & Innovation (15%)

We want to know that your technology infrastructure is keeping up with the times by your ability to respond to competition as well as in meeting sudden business/operational contingencies |

|

|

|

|

| DS |

Digital Strategy (15%)

We assess where your institution is in the digital journey |

|

|

|

|

| PS |

Products & service capabilities (10%)

As corporates needs evolve rapidly, how are you meeting those to enrich their experience from a product and service process perspective |

|

|

|

|

| CC |

Channel capabilities (10%)

We watch for a multi-channel approach to transaction banking to meet the demand of new age consumers |

|

|

|

NA |

| FP |

Consistent financial performance (10%)

We look for sustainable growth in revenue, profitability and deposit market share |

|

|

|

|

| BM |

Business mandates (10%)

We assess the institutions' ability to win and implement business mandates |

|

|

|

|

| HR |

Human resource capabilities (5%)

Human touch to technology and business is vital. We want to know the mixture of incumbent and new blood in the organisation and the ability to mobilise your employees to support a programme |

|

|

|

|

The Asian Banker staffs are committed to strict confidentiality and integrity. All staff and advisors are strictly prohibited in trading in the securities of participating institutions during the evaluation period. All researchers and advisors are not allowed to accept formal gratuity during this evaluation process.

All information will be kept strictly private and confidential, and will be used only for the evaluation under this award programme and the benchmarking reports to be derived from them.

If you have any difficulties in completing this form or require additional assistance or would like to make submissions, you may visit the website www.theasianbanker.com

You can also contact Mr. Siddharth Chandani at schandani@theasianbanker.com

| Dimension Code | Dimension | Transaction and Cash Management Indicator | Trade & Supply Chain Finance Indicator Finance Indicator | Payments/FX Indicator |

|---|---|---|---|---|

| CX |

Corporate customer matrix (25%)

We want gauge the relationship with your corporate clients through their experiences of key services and your own business structure |

|

|

|

| TI |

Technology & Innovation (15%)

We want to know that your technology infrastructure is keeping up with the times by your ability to respond to competition as well as in meeting sudden business/operational contingencies |

|

|

|

| DS |

Digital Strategy (15%)

We assess where your institution is in the digital journey |

|

|

|

| PS |

Products & service capabilities (10%)

As corporates needs evolve rapidly, how are you meeting those to enrich their experience from a product and service process perspective |

|

|

|

| CC |

Channel capabilities (10%)

We watch for a multi-channel approach to transaction banking to meet the demand of new age consumers |

|

|

|

| FP |

Consistent financial performance (10%)

We look for sustainable growth in revenue, profitability and deposit market share |

|

|

|

| BM |

Business mandates (10%)

We assess the institutions' ability to win and implement business mandates |

|

|

|

| HR |

Human resource capabilities (5%)

Human touch to technology and business is vital. We want to know the mixture of incumbent and new blood in the organisation and the ability to mobilise your employees to support a programme |

|

|

|

The Asian Banker staffs are committed to strict confidentiality and integrity. All staff and advisors are strictly prohibited in trading in the securities of participating institutions during the evaluation period. All researchers and advisors are not allowed to accept formal gratuity during this evaluation process.

All information will be kept strictly private and confidential, and will be used only for the evaluation under this award programme and the benchmarking reports to be derived from them.

If you have any difficulties in completing this form or require additional assistance or would like to make submissions, you may visit the website www.theasianbanker.com

You can also contact Mr. Siddharth Chandani at schandani@theasianbanker.com

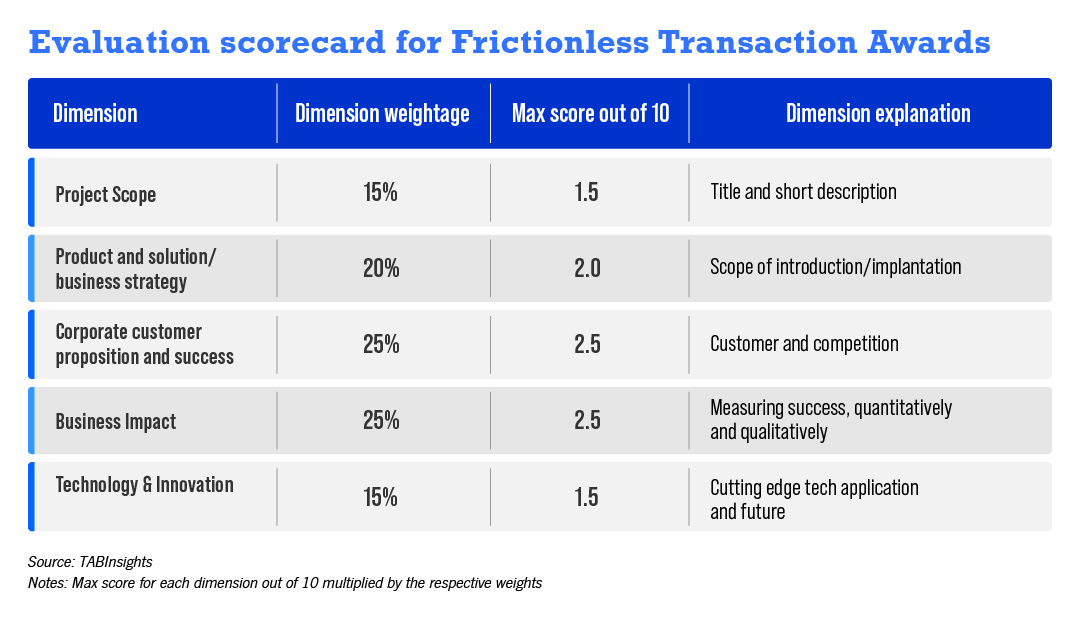

Evaluation scorecard for Frictionless Transaction Awards

| Dimension | Dimension weightage | Max score out of 10 | Dimension explanation |

|---|---|---|---|

| Project Scope | 15% | 1.5 | Title and short description |

| Product and solution/business strategy | 20% | 2 | Scope of introduction/implantation |

| Corporate customer proposition and success | 25% | 2.5 | Customer and competition |

| Business Impact | 25% | 2.5 | Measuring success, quantitatively and qualitatively |

| Technology & Innovation | 15% | 1.5 | Cutting edge tech application and future |

Source: TABInsights, Notes: Max score for each dimension out of 10 multiplied by the respective weights .

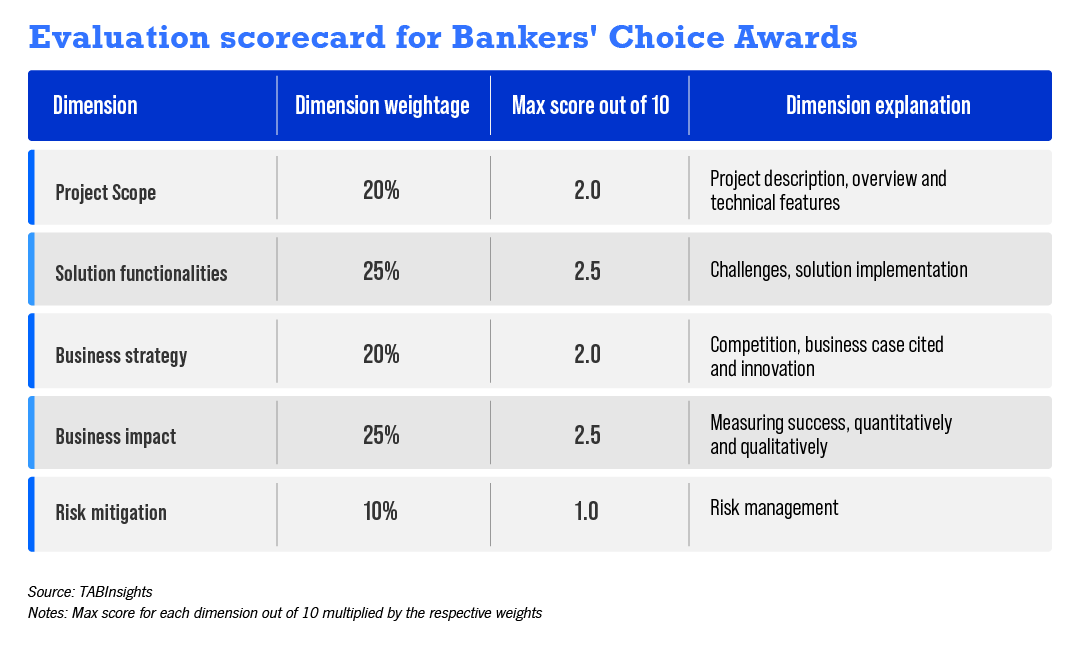

Evaluation scorecard for Bankers’ Choice Awards

| Dimension | Dimension weightage | Max score out of 10 | Dimension explanation |

|---|---|---|---|

| Project Scope | 20% | 2 | Project description, overview and technical features |

| Solution functionalities | 25% | 2.5 | Challenges, solution implementation and COVID-19 impact mitigation |

| Business strategy | 20% | 2 | Competition, business case cited and innovation |

| Business Impact | 25% | 2.5 | Measuring success, quantitatively and qualitatively |

| Risk mitigation | 10% | 1 | Risk management |